In the realm of accounting and bookkeeping, managing client authorisations with HMRC has historically been a cumbersome and time-consuming task. The introduction of Engager.app’s HMRC 64-8 Agent Authorisation integration marks a significant advancement, alleviating many of the challenges professionals have faced for years.

The Traditional Challenges of HMRC 64-8 Authorisation

Previously, obtaining agent authorisation via HMRC’s 64-8 form involved a series of manual steps that were prone to delays and inefficiencies:

-

Manual Paperwork: Agents were required to complete and submit paper forms, leading to potential errors and prolonged processing times.

-

Disjointed Systems: Managing authorisations necessitated navigating separate HMRC platforms, disrupting workflow continuity.

-

Lack of Real-Time Updates: Agents often operated without immediate insights into the status of authorisation requests, hindering proactive client communication.

These obstacles not only consumed valuable time but also posed risks to client satisfaction and compliance standards.

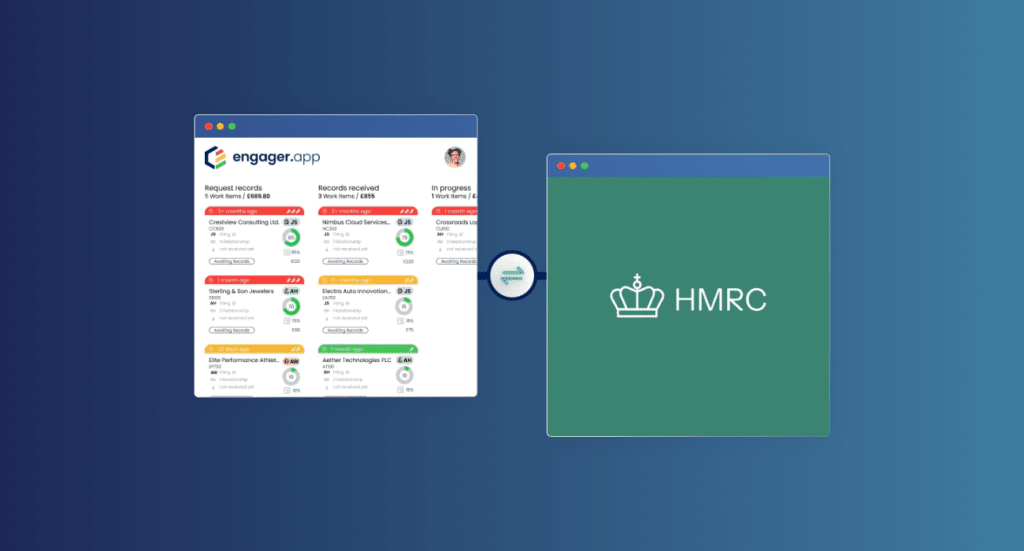

Engager.app’s Innovative Solution

Recognising these challenges, Engager.app has developed an integration that seamlessly incorporates HMRC’s 64-8 agent authorisation process into its platform:

-

Direct Integration: Initiate and manage agent authorisation requests for services such as MTD VAT, PAYE & CIS, Corporation Tax, and Self-Assessment directly within Engager.app, eliminating the need to switch between systems.

-

Real-Time Tracking: Monitor the status of each authorisation request, enabling timely updates to clients and more efficient practice management.

-

Centralised Dashboard: Access all client authorisation information in one unified location, streamlining workflows and reducing administrative burdens.

Get an insight into our integration by watching this brief overview video:

Addressing Specific Pain Points

The integration directly tackles the previously mentioned challenges:

-

Eliminating Manual Processes: By digitising the authorisation workflow, the integration reduces errors associated with manual data entry and accelerates processing times.

-

Enhancing System Cohesion: Agents can manage all aspects of client authorisation within Engager.app, fostering a more cohesive and efficient operational environment.

-

Providing Immediate Insights: Real-time tracking empowers agents with up-to-date information, facilitating proactive client engagement and improved service delivery.

How Engager’s HMRC 64-8 Integration Works

Engager.app’s HMRC 64-8 Agent Authorisation integration streamlines the process of managing client authorisations for various tax services. Here’s a concise overview of how it functions:

-

Initiate a Code Request:

-

Directly within Engager.app, you can request agent authorisation for services including:

-

PAYE/CIS

-

Self-Assessment

-

Corporation Tax

-

MTD VAT

-

MTD IT

-

-

This eliminates the need to log in separately to HMRC’s platform, streamlining your workflow.

-

-

Track the Code Status:

-

Monitor the progress of each authorisation request in real-time within Engager.app.

-

This centralised tracking ensures you’re always informed about the status of your requests, enhancing efficiency.

-

-

Enter the Received Code:

-

Once your client provides the authorisation code sent by HMRC, input it directly into Engager.app.

-

Engager.app will then validate the code with HMRC and update the client’s authorisation status accordingly, ensuring compliance and accuracy.

-

By integrating these steps into your practice management, Engager.app reduces administrative burdens, minimises errors, and enhances client communication, allowing you to focus more on delivering quality services.

For a detailed walkthrough, refer to our How-To Guide.