Why Pricing Strategies Matter in 2024

As we move into 2024, the landscape for accountants and bookkeepers continues to evolve rapidly. From inflation and economic uncertainty to advances in technology and rising client expectations, firms need to remain agile in how they price their services. The old hourly rate model no longer captures the true value of work, making it crucial to adopt smarter, value-based pricing strategies. Recognising this, we teamed up with Jo and Zoe from The 6 Figure Bookkeepers to explore the most effective pricing strategies for the year ahead.

As the industry evolves, pricing is becoming a critical area where firms must stay agile and proactive. Jo and Zoe brought their wealth of experience to the table, discussing findings from their third pricing survey and sharing practical tips to help businesses thrive.

Download the Pricing Survey

Stay ahead in 2024 by downloading The 6 Figure Bookkeeper’s comprehensive pricing survey. Learn how accountants and bookkeepers across the industry are structuring their fees, and discover the key trends that can help you enhance your own pricing strategy.

Understanding the Importance of Value-Based Pricing

The webinar highlighted a common struggle among bookkeepers and accountants: how to set prices that reflect the value of the work they deliver. Jo and Zoe emphasised that the traditional hourly rate model often falls short. It doesn’t account for the true impact professionals have on their clients’ businesses, such as tax savings, improved compliance, and peace of mind. Instead, they advocated for outcome-based pricing, where the focus shifts to the transformation and value provided rather than the hours spent.

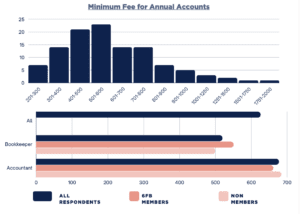

Insights from the latest pricing survey were integral to this discussion. One notable finding revealed that while more bookkeepers and accountants are moving away from hourly billing, a significant portion still struggles to determine the right pricing for their services. The survey indicated that firms charging value-based fees saw an average 15% increase in revenue compared to those sticking with traditional hourly rates. This data underscores the importance of transitioning to a pricing model that accurately reflects the value delivered.

For example, one of the firms featured in the webinar successfully implemented outcome-based pricing. They transitioned from hourly billing to fixed fees for services like VAT returns and payroll, aligning their fees with the actual results they delivered to clients. This approach not only improved their profitability but also strengthened client relationships, as clients appreciated the transparency and predictability of the pricing structure.

Jo shared an analogy of a 13-year-old contemplating the worth of their time while waiting in a queue at an amusement park. This analogy effectively illustrated that time alone doesn’t capture the full value of what is being offered. The real challenge lies in breaking free from the mindset of trading hours for money and embracing a pricing strategy that reflects the results delivered to clients.

Confidence and Pricing: A Vital Connection

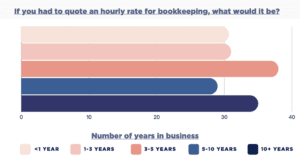

One of the recurring themes was the link between confidence and pricing. Jo and Zoe highlighted that confidence in your pricing often grows with experience. However, they noted that even seasoned professionals sometimes struggle to raise their rates to match their expertise. This hesitation can stem from a fear of losing clients or not feeling “worthy” of higher fees.

Data from the survey further supported this connection, showing that firms with higher confidence in their pricing were more likely to command premium rates. They encouraged attendees to recognise the value they bring and to confidently communicate this to clients. One of the key takeaways was the idea of gradually increasing prices for new clients while revisiting pricing for existing clients through regular reviews. This approach helps build confidence and ensures that your pricing keeps pace with the growing value you provide.

Quick Tip: Identify three clients whose prices you haven’t reviewed in over a year. Schedule a price review meeting and confidently explain the value your services have delivered over time.

Customising Pricing with Engager

During the webinar, we also demonstrated how Engager’s pricing tools can help streamline this process. We showcased how the software enables flexible pricing, allowing users to customise their fees based on various factors like client risk, service frequency, and catch-up work. With Engager, bookkeepers and accountants can build pricing structures that reflect the unique needs of each client, rather than relying on a one-size-fits-all model.

We introduced our new Catch-up Fees tool, which simplifies billing for backdated work by automatically calculating and spreading payments across a defined period. This helps to eliminate the guesswork and ensure that you are compensated fairly for your time and effort.

Beyond pricing, Engager offers powerful automation tools that can free up your time from repetitive tasks, such as client onboarding, invoicing, and task management. By automating these processes, you can focus more on delivering high-value services and less on administrative work. This not only improves efficiency but also allows you to scale your practice without compromising on service quality.

Quick Tip: Use Engager’s pricing tools to experiment with different pricing models. Start by setting up a catch-up fee for any outstanding work and review how this impacts your overall profitability.

Key Takeaways for 2024

- Embrace Outcome-Based Pricing: Shift from hourly billing to value-based pricing that aligns with the outcomes you deliver to clients.

- Build Confidence Gradually: Start by raising prices for new clients, and review existing client fees regularly. Confidence grows with consistency.

- Leverage Technology: Use tools like Engager to manage pricing, streamline processes, and ensure your business operates efficiently.

- Regular Price Reviews: Don’t wait years to adjust your rates. Aim to review pricing quarterly, taking into account inflation, business growth, and changes in the scope of work.

Jo and Zoe’s insights, combined with the practical features of Engager, provided a clear roadmap for pricing success in 2024. Whether you’re just starting out or you’ve been in business for years, these strategies will help you stay ahead in an increasingly competitive market.

“Did my first live pricing with a prospect today. Sooo good, I can deal with any queries or concerns straight off. Proposal sent while they were with me and fee agreed. 5 new self-assessments this week and proposal, engagement letter and onboarding forms all working an absolute dream.”

— Luke Fletcher, Raw Accounting

Ready to take your pricing to the next level? Sign up for a free trial of Engager today and start building a pricing strategy that reflects the true value of your services. Additionally, make sure to join our next webinar for more insights and tools to help your practice thrive in 2024.

To catch the full webinar replay and see the detailed breakdown of pricing strategies, watch the video below: